Share This Article

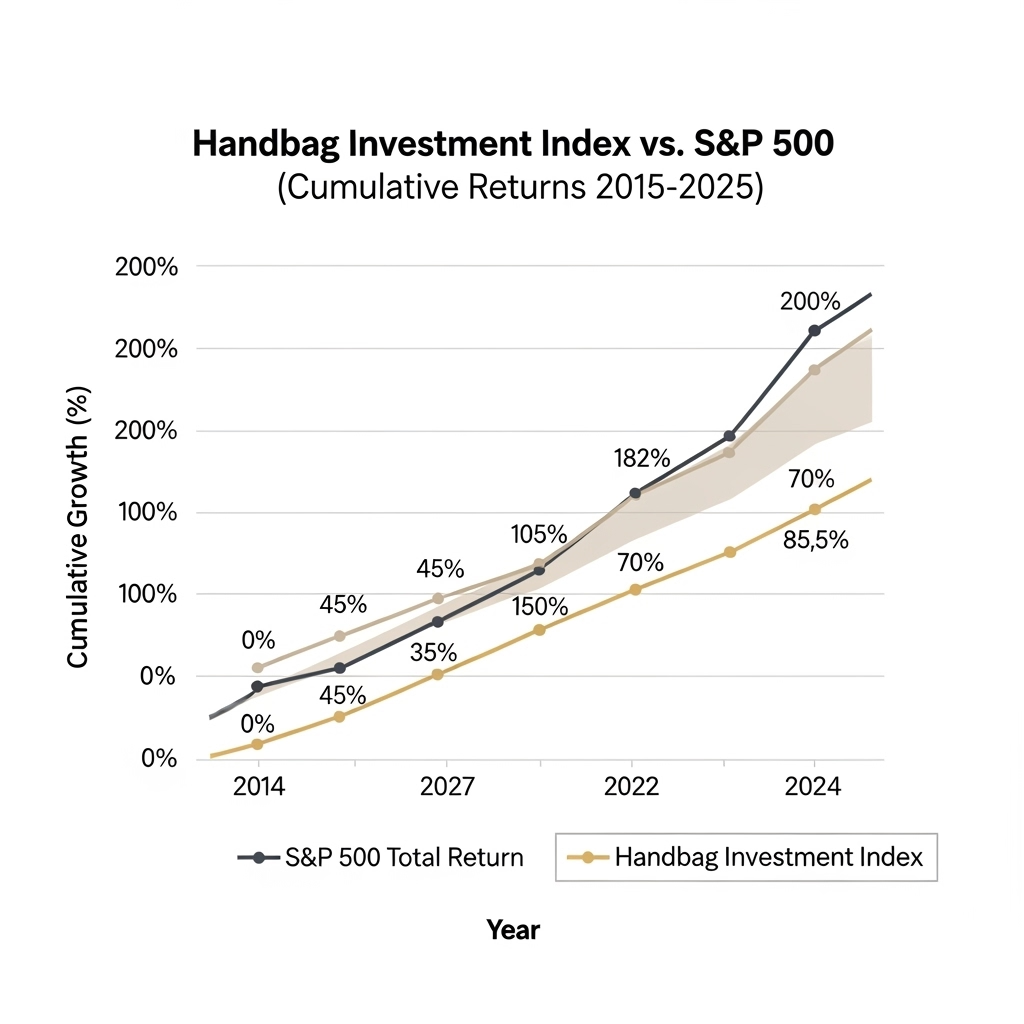

Can a handbag truly be a better investment than the stock market?

The data says yes. For years, a select group of iconic designs from houses like Hermès and Chanel have not only held their value, but appreciated at a rate that consistently outpaces traditional assets. This isn’t speculation; it’s a market reality driven by scarcity, heritage, and unparalleled craftsmanship.

You’re here to find out which specific bags make the cut. In this guide, I’m breaking down the five investment-grade icons that repeatedly prove their worth, giving you the clarity and data to transform a luxury acquisition into a strategic financial decision.

What Makes a Handbag a High-Return Investment?

So what turns a beautiful bag into a high-performing asset? It comes down to three core principles that these top houses have mastered.

First is deliberate scarcity. Brands like Hermès don’t simply sell you a bag; they grant you access. By tightly controlling their supply, they ensure demand always remains at a fever pitch. This makes the bags themselves a currency of status and desirability.

Second is unparalleled craftsmanship. These aren’t factory-line products. They are hand-stitched by artisans over many hours, using materials meant to last for generations. This commitment to quality ensures they endure not just as accessories, but as tangible heirlooms.

This isn’t speculation; it’s a market reality driven by scarcity, heritage, and unparalleled craftsmanship.

Finally, there’s the power of brand heritage. You’re not just buying leather and hardware; you’re buying into a legacy. That history gives these bags an intrinsic value that trendy items can never replicate.

The 5 Best Designer Handbags to Invest In

1. Hermès Birkin Resale Value and ROI

The Birkin isn’t just the most famous handbag in the world; it’s also the top-performing investment in its class.

The Hermès Birkin. The Birkin isn’t just the most famous handbag in the world; it’s also the top-performing investment in its class. Its value is driven by the legendary difficulty of acquiring one new, which fuels an incredibly strong secondary market where prices regularly exceed retail. The numbers are clear. The latest Knight Frank 2025 Wealth Report highlights the Birkin’s unique resilience and market-defying power. While the broader collectibles market saw varied growth, the report specifically notes that “the ultimate classic handbag, the Hermès Birkin… is now more valuable than ever when sold on the secondary market.” This confirms the Birkin’s status as a top-tier asset that remains exceptionally strong regardless of wider trends.

It is the definitive statement piece, instantly recognizable for its strong, elegant silhouette. To add this cornerstone asset to your collection, you can browse authenticated Hermès Birkin Bags on Sotheby’s.

2. The Hermès Kelly Investment Potential

The Hermès Kelly. The Kelly offers the same powerful investment potential as the Birkin but with a more understated, aristocratic grace. Named for Princess Grace Kelly, it has a timeless narrative that discerning collectors value. Its performance is just as robust as its more famous sibling, with smaller sizes like the Mini Kelly and rare colors often commanding the highest premiums on the resale market. As a versatile designer shoulder bag with its strap, it is both practical and precious.

The Kelly projects poises and a deep appreciation for classic design. Discover authenticated and timeless Hermès Kelly Bags at Fashionphile.

3. Chanel Classic Flap Annual Price Increases

The Chanel Classic Flap. The Chanel Classic Flap is one of the most reliable investments in luxury, thanks to a very simple and powerful strategy: Chanel consistently raises the retail price, year after year. This strategy of aggressive price hikes provides a clear upward trajectory for its value, directly boosting the resale market. The data on Chanel’s pricing strategy is clear. The US retail price of a Medium Classic Flap skyrocketed from approximately $4,900 in 2016 to $10,800 as of the March 2024 price hike—an increase of over 120% that directly fuels its secondary market value.

It’s also perhaps the most versatile luxury crossbody bag ever made. You can invest in this iconic piece with confidence here: Chanel Classic Flap at The RealReal.

4. The Dior Lady Dior Value Retention

The Dior The Lady. The Lady Dior holds its value for a different reason: it is a true work of art. Its architectural shape, signature “Cannage” stitching, and connection to Princess Diana give it an iconic status that transcends trends.Of course. Here is the full, clean text for the article with the recommended heading improvements and bolded lead-ins integrated for a smooth, readable, and highly optimized final version.

While its growth may be less aggressive than a Chanel Flap, its value is incredibly stable. Pristine models, especially in limited-edition finishes or sought-after mini and micro sizes, often retain over 90% of their retail value.

It’s a bag that signals a deep appreciation for design and history. Explore the collection to find your piece of wearable art: Dior Lady Dior Collection.

5. Louis Vuitton Neverfull Investment Performance

For those looking for a more accessible entry into handbag investing, the Neverfull is the smartest choice. It’s the workhorse of the designer tote bags category and has an incredible track record for value retention.

Thanks to its durable design and Louis Vuitton’s own steady price increases, a pre-owned Neverfull often sells for 85-95% of its current retail price. Proving that accessibility does not preclude stunning performance, the Neverfull is a powerhouse of value retention. The authoritative Rebag’s 2025 Clair Report revealed that in 2024, the Neverfull “maintained its resale dominance, achieving a 158% average value retention.” This remarkable return, turning a retail purchase into a significant profit, was directly amplified by the brand’s move to a waitlist system, cementing its status as a scarce and highly desirable asset.

It’s the quintessential luxury tote for travel and daily life. Find this hard-working asset here: Louis Vuitton Neverfull on Fashionphile.

How to Maximize Your Handbag Investment Return

Once you’ve decided to invest, the specific details of the bag you choose are critical. Here’s what the most discerning collectors look for.

Key Factors That Drive Handbag Resale Value

For a brand like Hermès, the details are everything. Discerning investors know that scratch-resistant Epsom leather often holds its structure better than softer leathers, which is key for long-term value. While gold hardware is the timeless choice, rarer finishes can command a premium. Most importantly, the current market strongly favors smaller sizes. A Birkin 25 or a Mini Kelly will almost always yield a higher percentage return than a larger version of the same bag.

Essential Handbag Care to Protect Your Asset

To protect your investment, you need to preserve its condition. Always keep the full set—the box, dust bag, and original receipts. Use a custom pillow or acid-free tissue to maintain the bag’s shape in storage, and keep it out of direct sunlight. For any repairs or serious cleaning, only use a trusted professional “bag spa”.

The Golden Rules for Acquiring Investment Handbags

A few years ago, I was considering my first major purchase on the secondary market and found two seemingly identical bags. One was listed for slightly less, but the other came with what the seller called a ‘full set.’ Before I did anything, I called a friend who built her career authenticating handbags for one of the top resale platforms.

Her advice was immediate and has stuck with me ever since. “Always pay the premium for the box,” she said. “Think of it this way: the bag is the art, but the full set—the box, the receipt, the dust bag—is its certificate of authenticity and provenance. It’s the difference between a beautiful item and a legitimate asset.” She explained that on their platform, pieces with a complete set consistently sell faster and for 15-20% more.

That lesson—that you’re not just buying an object, but its complete and verifiable story—is the foundation for these essential rules of acquisition.

A Future Collectible The Goyard Saint Louis Tote

Beyond the established top five, astute collectors are watching one particular bag that shows all the signs of becoming a future icon: the Goyard Saint Louis PM Tote.

Goyard’s history predates even Louis Vuitton’s, and their fierce commitment to exclusivity—they do not sell their products online—creates a natural scarcity. The Saint Louis tote already has exceptional value retention on the secondary market. For the collector looking to diversify, it is a wonderfully strategic acquisition.

Which Investment Handbag Is Right for You?

The evidence is clear: the right handbag is a powerful and rewarding asset. So which is right for you?

For the highest potential returns and unmatched status, the Birkin and Kelly are in a class of their own. For transparent, steady growth, the Chanel Classic Flap is a proven performer. And for an accessible entry with rock-solid value, the Neverfull is an intelligent choice.

Ultimately, this is a decision that satisfies both the head and the heart—a chance to own a piece of art that also happens to be a brilliant investment.

Frequently Asked Questions About Investing in Handbags

Is a Birkin bag really a better investment than stocks?

While direct comparisons depend on the timeframe, the Knight Frank 2025 Wealth Report provides the clearest data on the Birkin’s power as a long-term asset. It confirms that the handbag asset class, led by the Birkin, has appreciated 72.6% over the last decade. This demonstrates significant, stable growth that is competitive with traditional investments, but with the unique value protection offered by extreme scarcity.

What is the best entry-level designer bag to invest in?

The Louis Vuitton Neverfull is widely considered the best entry-level investment. Its relatively accessible price point, combined with its durability and high value retention (often 85-95% of retail) on the resale market, makes it a safe and intelligent first choice. According to the Rebag 2025 Clair Report, the Louis Vuitton Neverfull is a top-performing accessible piece. As a brand, Louis Vuitton retains an average of 93% of its value. The Neverfull is a key driver of this, with its move to a waitlist system increasing its scarcity and further cementing its status as an asset that holds its value exceptionally well.

How much does a Chanel Classic Flap appreciate each year?

There is no fixed annual percentage published by Chanel. However, the bag’s appreciation is directly tied to its retail price history, which is publicly tracked. As documented by authorities like Sotheby’s, the price has increased by over 120% since 2016. This history of aggressive and consistent price hikes is the primary data that confirms its remarkable appreciation rate.

Does having the original box and accessories really matter for resale?

Yes, it is a critical factor in maximizing value. While condition is paramount, a “full set”—which includes the original box, dust bag, and receipts—provides this verifiable history. A bag with its complete original set is considered more desirable by serious collectors and can command a significant premium at auction compared to a similar bag without it.

Do certain colors or leathers have better resale value?

Yes, both color and material dramatically influence investment value. Timeless neutral colors like black, beige, and grey are consistently the safest investments and top performers on luxury resale markets. While vibrant, seasonal colors can be popular, classic neutrals have broader, more sustained demand. For materials, durable leathers like Hermès’ Togo or Epsom are highly sought after because they maintain their structure and condition well over time, directly protecting the bag’s value.

What is the best way to sell an investment handbag?

The best method depends on the bag’s rarity, your goal and your timeline.

- Online Resale Platforms like The RealReal or Vestiaire Collective offer a broad audience and handle the logistics of authentication, photography, and shipping in exchange for a commission. This is often the most straightforward path for popular, high-value bags.

- Major Auction Houses are the premier choice for truly rare or extraordinary pieces (like a limited-edition exotic skin bag). An auction can create a competitive bidding environment among global collectors, potentially achieving a record-setting price far above a standard consignment value.